Accounting for Forest Carbon Markets: An Informed Approach

News Release

Carbon Conundrums:

Do United States’ Current Carbon Market Baselines Represent an Undesirable Ecological Threshold?

A.W. D’Amato1, C.W. Woodall2, A.R. Weiskittel3, C.E. Littlefield1,4, L.T. Murray5

1University of Vermont, Rubenstein School of Environment and Natural Resources; 2USDA Forest Service, Forest Inventory & Analysis;

3University of Maine, Center for Research on Sustainable Forests; 4Conservation Science Partners;

5USDA Forest Service, Inventory, Monitoring, and Assessment Research

In this new commentary just published in Global Change Biology (https://doi.org/10.1111/gcb.16215), D’Amato et al. respond to the challenge raised by Anderson-Teixeira & Belair’s (2021) call for better integration of the latest science to inform effective carbon mitigation and markets.

Along with a growing recognition of the value of forest ecosystems as a natural climate solution especially in states like Vermont and Maine, there has been explosive interest in forest carbon (C) markets and associated private capital in recent years, which has not been without controversy. As a result, there is a real need to improve C accounting methodologies associated with enrollment in these markets to enable more credible estimates of C mitigation potentials and pricing based on objective baselines.

D’Amato et al. argue that the design of current offset programs relies on absolute and simplistic ecological metrics to provide incentives that do not reflect real climate benefits (e.g., California’s carbon program [Badgley et al. 2021]). Such metrics may ignore differences in forest developmental stage, biological potential for sequestration, and emission risks of natural disturbances that can be compounded by climate change.

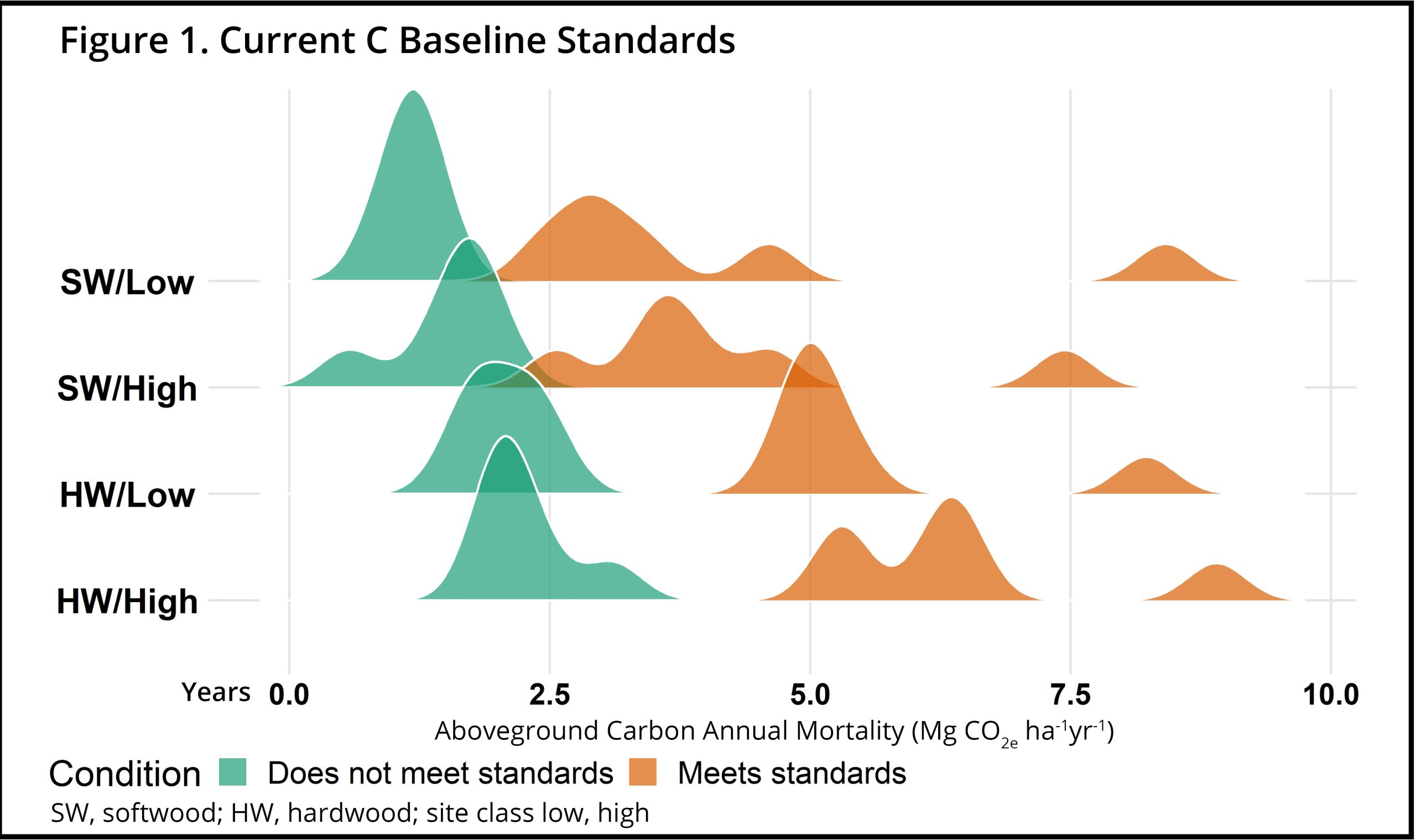

The research team proposes an alternative approach using biophysically relevant and robust forest development measures such as relative density (RD) that can help guide management towards optimizing sequestration, while affording adaptability under changing conditions. In the commentary, the authors compare such an approach with absolute metrics C accounting methodologies that are predominantly used in offset markets and conclude that this type of approach rewards current conditions and historic sequestration without factoring in future vulnerability. For example, forests that currently exceed C baseline standards have experienced much greater annual mortality rates in the last 10 years than those below the standards, limiting overall reliability of baseline accounting (Figure 1).

Instead, they contend, using the optimum RD as a guide allows for multiple management strategies to be used more effectively, allowing additional objectives like production of long-lived forest products or provision of wildlife habitat to be achieved. This strategy may help ensure policies intended to mitigate climate change do not over-credit or incentivize nonadditional forest C offsets.

The study’s lead author, University of Vermont Professor Dr. Tony D’Amato, suggests, “Carbon markets currently support the idea of improved forest management, but this recent research suggests that they may not always improve forest conditions in the short-term and, by promoting vulnerable conditions, are often not supporting climate change mitigation over the long term.”

Contact: Anthony W. D’Amato, University of Vermont, Rubenstein School of Environment and Natural Resources, awdamato@uvm.edu

References

Anderson‐Teixeira, K.J., Ethan P. Belair, E.B. (2021). Effective forest‐based climate change mitigation requires our best science. Global Change Biology, 28, 1200-1203. https:// 10.1111/gcb.16008

Badgley, G., Freeman, J., Hamman, J. J., Haya, B., Trugman, A. T., Anderegg, W.R.L., & Cullenward, D. (2021). Systematic over-crediting in California’s forest carbon offsets program. Global Change Biology, 28, 1433–1445. https://doi.org/10.1111/gcb.15943